Hush-hush! Wanna buy an Oscar? Where are all of the Academy Awards that have gone missing? Is an Oscar cat burglar on the loose?

Read Steve Rose's recent article in the Guardian UK to find out the some answers to those mysteries in his interview with veteran appraisal and celebrity memorabilia expert Caroline Ashleigh, AAA of Caroline Ashleigh Appraisers & Auctioneers

The Detroit Institute of Arts ranks ahead of every other art museum in the U.S. in USA Today’s annual 10Best Competition for top art museum.

“Housed within a Beaux Arts building, the Detroit Institute of Arts maintains a collection of some 65,000 works - among the largest and most comprehensive in the United States,” USA Today wrote about its winner. “Visitors can explore human creativity from across the globe as they explore more than 100 galleries

The DIA was nominated by a panel of experts made up of editors from both USA Today and 10Best.com. The top 10 was then determined by a public vote.

"We couldn't be prouder of our museum, our amazing team, and the community we serve. Thank you to everyone who voted for us and who supports our mission of inspiring and enriching lives through art. We will continue to work hard to provide incredible experiences for our visitors and to celebrate the power of art in all its forms."

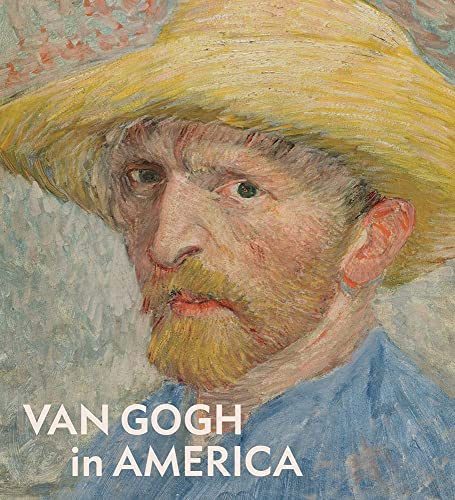

The DIA recently brought in around 70 works from Vincent Van Gogh from around the world "Van Gogh in America" exhibition. The exhibition was six years in the making

Do you love watching @CBSSunday as much as we do? Check out the interview with curator Jill Shaw discussing the blockbuster exhibition "Van Gogh in America." https://cbsn.ws/3TvjpHR

One hundred years ago the Detroit Institute of Arts became the first museum in the U.S. to buy a work by Vincent Van Gogh, the Dutch Post-Impressionist who died in 1890. Now, the DIA honors the centenary of that landmark acquisition by presenting "Van Gogh in America," featuring 74 works from around the world, which explores America's introduction to the artist.

Back in 1962 when Andy Warhol featured the Campbell brand in his artwork, Campbell had some initial concern about his use of their trademark, but ended up commissioning a piece from Warhol. Today, the company has a soup can painting prominently hanging in their New Jersey headquarters

In1966, Campbell invited consumers to send in soup can labels, plus one dollar, in exchange for a Warhol designed dress made of paper. The rarity of that iconic 60's dress today is partly due to the fact that few have survived. The Campbell 'Souper' dress, which was featured on Antiques Roadshow several years ago by appraiser Caroline Ashleigh, is selling for approximately $20,000 in today's market

This rare Third Imperial Fabergé Easter egg, made for the Russian Imperial family in 1887 and said to be worth tens of millions of dollars, was confiscated by the Bolsheviks after the Russian Revolution. In 1964 it was auctioned in New York as a “Goldwatch in Egg Form Case” for $2,450 – its origin was unknown at the time. Later, a buyer in the US Midwest bought it at a flea market for what was believed to be scrap metal value until he discovered its true value after many years. The value of the egg has now been estimated to be in the range of over $33 million dollars

Recently my colleague Anne Igelbrink shared the following enticing new information that has come to light regarding the largest unsolved art heist in history:

"I vividly remember waking up as a Wellesley undergraduate in 1990 to hear of the staggering theft of paintings and objects from the Isabella Steward Gardner museum in Boston. It included this seascape by Rembrandt--the only one he is known to have painted--along with two other works as well as those by Vermeer, Degas and Chinese bronzes. Despite many leads and an excellent recent documentary on Netflix (This is a Robbery), nothing has ever been recovered and it remains the world's biggest art heist. However, another tantalizing clue has recently emerged as Robert Calantropo, a Boston area jewelry appraiser and childhood friend of Bobby Donati, one of the key suspects, has confessed that he was shown the Napoleonic eagle finial which was also stolen. Donati was murdered in 1991 but being an eternal optimist, I hope this will lead to to some or all of the works' recovery".

Antiques Roadshow Has a Renegade Message - "The Surprising Politics of Antiques Roadshow" by Stephen Lurie

The show is about finding out how much your possessions are worth. But it has stayed popular because it values knowledge over money

These little known masterpieces invite you to look differently at hand-carved works of art designed to redirect light and attention to the paintings they surround.

This image, from The Louvre's Department of Paintings, pays tribute to the inventiveness and technical virtuosity of frame manufacturers, in Italy in the 16th century, Netherlands in the 17th century and in France in the 18th century

Detail of a French frame from the 18th century

Netflix’s latest true crime documentary will revisit the infamous heist at Boston’s Isabella Stewart Gardner Museum, an unsolved robbery in which a pair of thieves posing as policemen tied up a night watchmen and made off with 13 masterpieces by Rembrandt, Vermeer, Degas, and Manet, collectively worth an estimated $500 million. There is still a $10 million reward for information leading to the paintings’ return, and it remains the most expensive art theft in US history.

No one has ever been arrested or tried in connection with the case, leading to any number of theories about what really happened and where the paintings are. Both the Italian mafia and the Irish mob are suspected of being involved, and efforts to recover the works have spanned continents.

Search

Trending Topics

Tune in to see me on the new @RoadshowPBS episode, airing 5/27/2024 at 8/7C on @PBS!

Tuesday, 28 May 2024

Tuesday, 28 May 2024

- Friday, 17 March 2023 Expert Caroline Ashleigh Reveals How Much Oscar is Worth and the Murky After-Market

- Friday, 24 February 2023 Detroit Institute of Arts Named #1 Museum in America

- Sunday, 13 November 2022 Van Gogh in America

- Sunday, 25 September 2022 The Curious Relationship between Campbell Soup and Andy Warhol

- Friday, 26 August 2022 Flea Market Faberge

- Wednesday, 08 December 2021 Enticing New Clues About the Largest Unsolved Art Theft in History

- Wednesday, 01 September 2021 What We Are Reading Now...

- Thursday, 19 August 2021 Every Picture (Frame) Tells a Story

- Sunday, 14 March 2021 This is a Robbery: The World's Biggest Art Heist

More inBlogs